ActivTrades Review

Note: Approximately 74 to 89% of retail traders lose money while trading, consider the risk while trading with ActivTrades.

Rating Breakdown

- 4/5

- 4/5

- 4/5

- 4.5/5

ActivTrades is the best forex broker that offers forex trading services for institutional and retail investors. It was initially founded in 2001, when it became the market leader for Italy, Germany, and France. It moved its headquarters from Switzerland to London in 2005. ActivTrades has recently opened offices around the world, including one in Dubai, which specializes in trading needs within the Middle East. Let’s have an in-depth analysis and get an honest ActiveTrades review of its features.

10 Points Summary

UK

FCA, CBS

MT4, MT5

24/5

0.63 pips

Available

250 US$

USD, GBP, EUR

Education center and contests

50 currency pairs, cryptocurrencies, metals, indices, commodities, and shares.

Is ActivTrades a Good Forex Broker ?

ActivTrades offers a wide range of benefits that enhance the trading experience and improve accessibility for traders.

Proposed benefits include access to diverse financial instruments, awarded platforms, complete trading solutions, and exceptional trading tools. Clients can access over 50 currency pairs along with metals, indices, cryptocurrencies, commodities, shares, and ETFs. Also, UK clients can access spread betting.

ActivTrades has earned a lot of respect and recognition in the past years. Official numbers back this up, with a recent survey showing 95% customer satisfaction. This means 9 out of 10 clients rated their trading experience with ActivTrades Corp. as good or excellent.

Pros & Cons

| Pros | Cons |

| Low trading fees | Slim product portfolio |

| Excellent account opening | Basic research tools |

| Free deposit and withdrawal | Inactivity fee |

How to open your ActivTrades Account

ActivTrades is a reliable broker with an excellent trading environment and powerful technology. The account opening procedure is fully digital, easy, and fast. The account will be verified within a day.

The first step in opening an account is choosing your country of residence and entering some basic details about yourself, such as your name, email address, and password. ActivTrades may offer a different legal entity for registration, depending on your country of residence. This is significant because the entity affects your investor protection, and products and fees might also be different.

Then you have to complete a four-step registration process.

- Account holder information: personal details, home address, tax residency

- Trading experience: how long you have been trading in CFDs, the number of trades, the average lot size per trade

- Financial and account information: employment status, income, and savings, source of funds, trading preferences

- Trading account setup: choose your trading platform and the base currency.

Finally, add your documents (ID or passport, bank statement or utility bill, etc.) and a photo for client verification.

ActiveTrades offers different account types for traders, including individual or professional accounts. Individual accounts allow trading in mini- and micro-lot transactions, while professional accounts require significant financial portfolios exceeding $500,000. Of course, it is clear that brokers offer free demo accounts, which provide convenience for beginners. Respectively, Islamic or Sharia law-compliant accounts are also available.

Leverage In Forex

ActivTrades offers a tight spread, no hidden fees, and no rejections. The platform supports fast execution speeds, helping traders take advantage of market movements with minimal delay.

Residents of Dubai or the Bahamas cannot leverage more than 1:30 on major currency pairs regulated by FCA regulation. However, they can get up to 1:400 on other Forex products that are not regulated in the same way as these major currency pairs.

ActivTrades offers an excellent trading experience with competitive spreads and live chat services. If you’re interested in opening a forex account with them, then go ahead.

The aforementioned ActivTrades leverage of 1:400 for residents living within Dubai or the Bahamas entity does not apply to major currency pairs, which are monitored by key implications like FCA regulation that strictly restricts it at max 1 for residents residing overseas but allows higher amounts when dealing locally (max is also different depending on the resident country).

Awards

ActivTrades Corp. has been in business for 20+ years and is internationally recognized. You should know that many people have acknowledged Activ Trades success over the last two decades, so take note of these facts: 95% customer satisfaction. In a recent survey, nine out of ten users described their overall experience as good or excellent with ActivTrades.

Is ActivTrades Safe or a Scam

ActivTrades is a trusted and reliable investment firm that has been doing its best to improve services since it was founded. It offers low-risk trading, which means traders can be at peace knowing their investments are safe with this company.

Is ActivTrades Legit?

ActivTrades is regulated by the Financial Conduct Authority (UK) and is a member of the Financial Services Compensation Scheme. Meanwhile, Activ Trades is also regulated by the Dubai Financial Services Authority and operates under an offshore entity located in the Bahamas.

ActivTrades provides protection from negative account balances and funds in segregated accounts, accompanied by additional insurance for up to $1 million, making them much safer than other brokers.

Instruments

When it comes to trading for UK residents, they can choose from a range of financial instruments like cryptocurrencies and indices. We also have access to commodities and spread betting. Alongside these widely offered trading instruments is the ability to trade US T-notes and German bonds as well.

Fees

When you use ActivTrades, here are the fees: a spread in forex when trading, and non-trading fees (such as monthly maintenance).

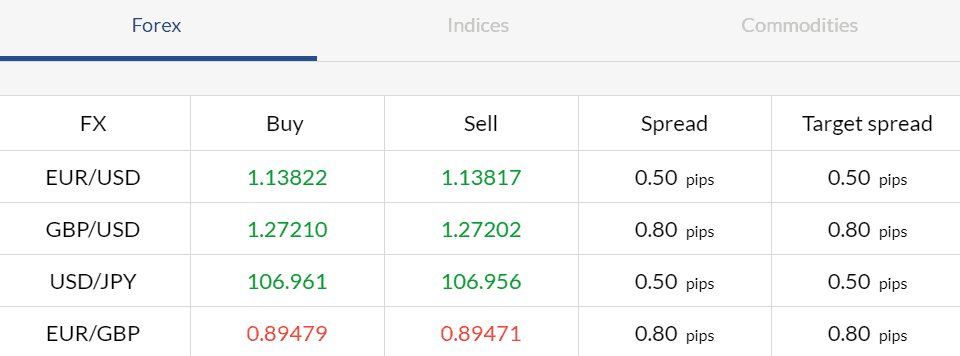

Activtrades Spread

ActiveTrades Spreads for currencies and financial CFDs start as low as 0.5 pips, depending on the asset. This makes it one of the most favorable brokers on these types of trades, with commissions starting at €1 per side and commission-free spread betting shares trading. a clear opportunity to trade in various instruments.

Besides this, there is no overnight adjustment (the underlying futures price already accounts for the adjustment), which reduces the possible risks or errors you may make when calculating positions by yourself.

ActivTrades is a popular CFD broker that offers good opportunities, not just for traders who use more mainstream instruments like currency pairs and futures contracts but also for those who are interested in trading more exotic instruments, such as index options or volatility indexes.

ActivTrades Review

Snapshot of Forex Spread

Methods of Payment

Clients can complete deposits from their online personal area with just a few clicks, making the process much less time-consuming and easier.

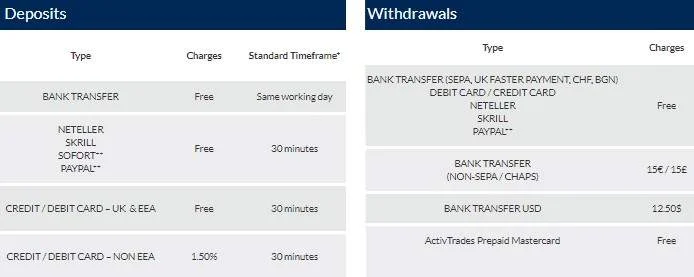

Deposit Options

ActivTrades Plc offers various payment options, like bank transfers and credit/debit cards. They also accept Neteller, Skrill, and Sofort as forms of payment. On top of this, the company offers an ActivTrades Prepaid Card, which includes free monthly service and has no fees. This card gives you all the benefits of a Mastercard, so there are minimal fees that you have to pay while taking care of your own finances on the go.

What is the Minimum Deposit?

ActivTrades requires a minimum deposit of $250, which means you can start trading on the platform right away.

Withdrawals

ActivTrades doesn’t charge clients for deposits made using bank transfers or e-wallets, but there is a drawback. When withdrawing funds from your account, the investor needs to calculate 0.75% of credit card payments in the UK and EEA area or 1.5% outside this region. As far as withdrawal fees are concerned, transferring money to ActivTrades Prepaid Mastercard or an e-wallet will be free; however, 12$.50 USD withdrawals will cost due to currency conversion no matter where you live in the world!

Forex Trading Platforms

ActivTrades is the best forex trading platform provider, offering its proprietary ActivTrades trading platform and two other well-known platforms, MetaTrader 4 and MetaTrader 5, ActivTrades provides helpful tools for currency conversion and supports traders from various regions with localized features.

Web Trading

ActivTrades is a web-based online forex trading platform that allows you to trade straight from the browser. It also has an app for iPhone or iPad with a modern and easy-to-use interface, plus cutting-edge features for experienced traders of all trading styles. Not only does it have 90 technical analysis indicators on offer, but it also has more than 2500 symbols that can be traded.

Desktop Platform

- ActivTrades has a variety of user-friendly platforms for traders. They offer something for those who prefer MetaTrader4 and are not as experienced with MT5, but they also have advanced charts and security standards that come with automated trading through their EAs (Expert Advisors).

- MetaTrader5 is an updated platform that allows you to trade forex, stocks, ETFs, or 450 CFDs on various asset classes with advanced trading features. while facilitating automatic trades. It integrates your statements easily, too!

- ActivTrades has a variety of user-friendly platforms for traders. They offer something for those who prefer MetaTrader4 and are not as experienced with MT5, but they also have advanced charts and security standards that come with automated trading through their EAs (Expert Advisors).

Trading Tools

Besides the powerful platform and trade utilities, there are also numerous automation features available. These include trading tools, decision-making tools, or any of the indicators we have!

Customer Support

They offer a support and education center with live chat and an average 27-minute response time. Client service has won numerous awards for its innovative work. The main goal of the offered educational system is to keep traders up to date with new developments in technology, market trends, and features.

Education

ActivTrades is committed to providing you with access to a range of educational materials, analyses, and courses. They also have an inbuilt powerful analytical tool that will allow you to better learn and trade. What’s more, if you open up your demo account here, they will generously give you $500 worth of free trades upon signing up.

FAQ's

1. Is ActivTrades a regulated and safe broker?

- FCA (UK)

- SCB (Bahamas)

- DFSA (Dubai)

Funds are kept in segregated accounts, and there’s negative balance protection + $1M insurance for extra security.

2. What are the minimum deposit and spreads?

- Minimum deposit: $250

- Spreads start from 0.5 pips (e.g., EUR/USD at 0.63 pips)

- No commission on most forex pairs (spread-only pricing).

3. Which trading platforms does ActivTrades offer?

4. What leverage can I get?

- UK/EU clients: Max 1:30 (due to FCA rules)

- Bahamas/Dubai clients: Up to 1:400 (on non-major pairs)

5. Are there any hidden fees?

- No deposit fees

- No withdrawal fees for e-wallets

- Inactivity fee applies if the account is dormant

6. Does ActivTrades offer a demo account?

Conclusion - ActivTrades Review

ActivTrades provides you with educational materials, analyses, and courses in order to help you trade. The site also has an inbuilt powerful analytical tool that will help beginners learn better. Within our ActivTrades Review, we found satisfying trading conditions with low spreads, no dealing desk intervention in the trading process, and quite competitive conditions.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.